Bitcoin Hits a New High: Surpasses $100,000, Market Cap Exceeds $2 Trillion

Bitcoin reached a significant milestone, surpassing the long-anticipated $100,000 mark. Its market capitalisation also crossed $2 trillion, setting another record.Bitcoin Goes to the MoonThe latest price record was achieved on today morning during East Asian trading hours, as a sudden bullish trend propelled Bitcoin past $100,000. The price peaked at $103,500 before correcting slightly to $103,300 at the time of writing.Bitcoin’s market capitalisation has exceeded the $2 trillion mark within just 15 years of its existence, setting a remarkable record. In comparison, the global market cap of gold stands at approximately $17.7 trillion, while Nvidia and Apple, two leading US-listed stocks, have market caps of about $3.5 trillion each. Microsoft is valued at $3 trillion, with Google and Amazon at $2.2 trillion each."This milestone reflects growing confidence in Bitcoin as a store of value and a hedge against macroeconomic uncertainty," said Brett Reeves, Head of Go Network at BitGo. "It is the asset's global nature that is also giving it appeal, allowing anyone anywhere in the world to purchase it. This borderless asset continues to be adopted by individuals, institutions and governments alike, something that is envisaged to continue in the years to come."Anticipated Policy Changes Become CatalystsThe recent surge in the cryptocurrency’s value was driven by Donald Trump's victory as the 47th President of the United States. Throughout his campaign, Trump expressed strong support for cryptocurrencies, referring to himself as the “First Bitcoin President.” He also attended several Bitcoin conferences and pledged to introduce crypto-friendly policies.The anticipated policy shift in the United States is acting as a catalyst for the cryptocurrency market. Gary Gensler, Chair of the Securities and Exchange Commission (SEC), known for his anti-crypto stance, has confirmed his upcoming resignation. Trump recently has picked former SEC Commissionaire Paul Atkins takeover the top regulatory role again.There are also reports that the incoming Trump Administration is considering assigning the Commodity Futures Trading Commission (CFTC) responsibility for overseeing the entire cryptocurrency market. Rumours suggest one of two crypto-friendly candidates is likely to be appointed as the new CFTC Chair.Several of Trump’s aides have publicly expressed their support for cryptocurrencies and related policies. Vice President-elect JD Vance has confirmed that he holds Bitcoin, while Trump’s key aide, Elon Musk, is widely known for backing meme tokens, particularly Dogecoin."This price appreciation is driven by the perception of an incoming crypto friendly administration resulting from Donald Trump's election victory, as well as an increase in accessibility to digital assets for investors via the introduction of new Exchange Trade Products and greater regulatory clarity globally," said Pascal St-Jean, CEO at 3iQ. "Crypto is also being more widely accepted by governments around the world who are now more accepting of the benefits it delivers, namely financial inclusion."Recently, Russian President Vladmir Putin also touted Bitcoin, highlighting that it cannot be banned.BREAKING: ???????? Russian President Putin says "Who can ban #Bitcoin? Nobody." pic.twitter.com/6mJ664BZZ8— Bitcoin Magazine (@BitcoinMagazine) December 4, 2024Beyond Bitcoin, many altcoins have seen significant gains in recent weeks. XRP and Solana are among the top performers, while Ethereum, the second-largest cryptocurrency by market capitalisation, is showing strong bullish momentum. This article was written by Arnab Shome at www.financemagnates.com.

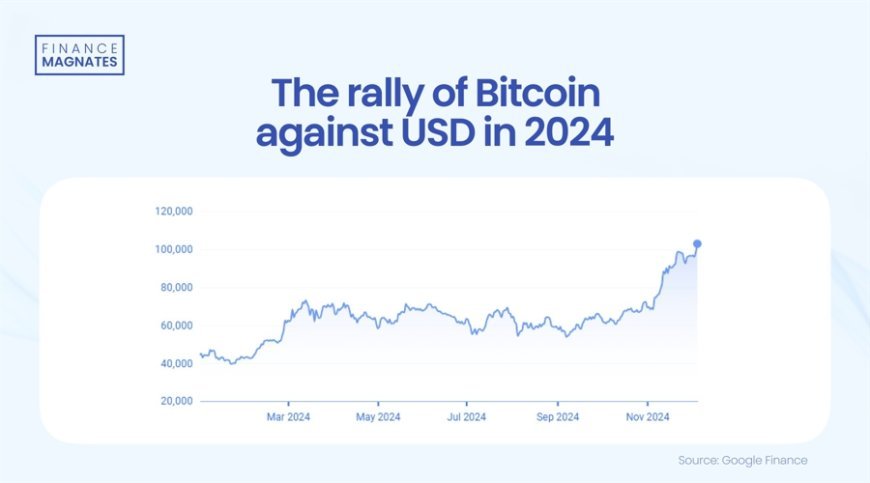

Bitcoin reached a significant milestone, surpassing the long-anticipated $100,000 mark. Its market capitalisation also crossed $2 trillion, setting another record.

Bitcoin Goes to the Moon

The latest price record was achieved on today morning during East Asian trading hours, as a sudden bullish trend propelled Bitcoin past $100,000. The price peaked at $103,500 before correcting slightly to $103,300 at the time of writing.

Bitcoin’s market capitalisation has exceeded the $2 trillion mark within just 15 years of its existence, setting a remarkable record. In comparison, the global market cap of gold stands at approximately $17.7 trillion, while Nvidia and Apple, two leading US-listed stocks, have market caps of about $3.5 trillion each. Microsoft is valued at $3 trillion, with Google and Amazon at $2.2 trillion each.

"This milestone reflects growing confidence in Bitcoin as a store of value and a hedge against macroeconomic uncertainty," said Brett Reeves, Head of Go Network at BitGo. "It is the asset's global nature that is also giving it appeal, allowing anyone anywhere in the world to purchase it. This borderless asset continues to be adopted by individuals, institutions and governments alike, something that is envisaged to continue in the years to come."

Anticipated Policy Changes Become Catalysts

The recent surge in the cryptocurrency’s value was driven by Donald Trump's victory as the 47th President of the United States. Throughout his campaign, Trump expressed strong support for cryptocurrencies, referring to himself as the “First Bitcoin President.” He also attended several Bitcoin conferences and pledged to introduce crypto-friendly policies.

The anticipated policy shift in the United States is acting as a catalyst for the cryptocurrency market. Gary Gensler, Chair of the Securities and Exchange Commission (SEC), known for his anti-crypto stance, has confirmed his upcoming resignation. Trump recently has picked former SEC Commissionaire Paul Atkins takeover the top regulatory role again.

There are also reports that the incoming Trump Administration is considering assigning the Commodity Futures Trading Commission (CFTC) responsibility for overseeing the entire cryptocurrency market. Rumours suggest one of two crypto-friendly candidates is likely to be appointed as the new CFTC Chair.

Several of Trump’s aides have publicly expressed their support for cryptocurrencies and related policies. Vice President-elect JD Vance has confirmed that he holds Bitcoin, while Trump’s key aide, Elon Musk, is widely known for backing meme tokens, particularly Dogecoin.

"This price appreciation is driven by the perception of an incoming crypto friendly administration resulting from Donald Trump's election victory, as well as an increase in accessibility to digital assets for investors via the introduction of new Exchange Trade Products and greater regulatory clarity globally," said Pascal St-Jean, CEO at 3iQ. "Crypto is also being more widely accepted by governments around the world who are now more accepting of the benefits it delivers, namely financial inclusion."

Recently, Russian President Vladmir Putin also touted Bitcoin, highlighting that it cannot be banned.

BREAKING: ???????? Russian President Putin says "Who can ban #Bitcoin? Nobody." pic.twitter.com/6mJ664BZZ8— Bitcoin Magazine (@BitcoinMagazine) December 4, 2024

Beyond Bitcoin, many altcoins have seen significant gains in recent weeks. XRP and Solana are among the top performers, while Ethereum, the second-largest cryptocurrency by market capitalisation, is showing strong bullish momentum. This article was written by Arnab Shome at www.financemagnates.com.