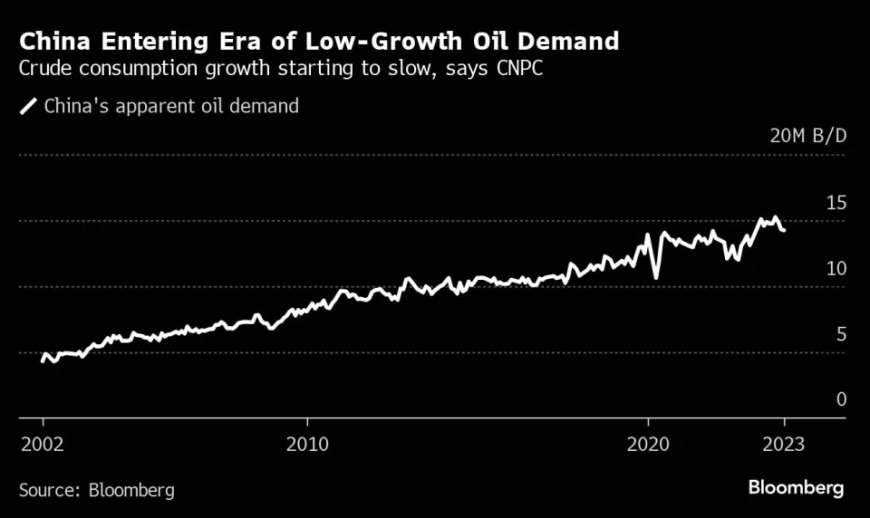

China's Oil Demand Growth Slowing, Entering Low Growth Era

The greater adoption of electric vehicles and trucks powered by liquefied natural gas will replace around 20 million tons, or 10% to 12% of China's gasoline and diesel consumption this year, said Lu Ruquan, president of the Economics & Technology Research Institute at China National Petroleum Corporation (CNPC), in an interview with Bloomberg Television.

The greater adoption of electric vehicles and trucks powered by liquefied natural gas will replace around 20 million tons, or 10% to 12% of China's gasoline and diesel consumption this year, said Lu Ruquan, president of the Economics & Technology Research Institute at China National Petroleum Corporation (CNPC), in an interview with Bloomberg Television.

Despite this, China's overall crude oil demand will continue to grow, aided by the expanding petrochemical sector, Lu said. As the world's largest oil importer, a slowdown in China's oil demand growth this year may act as a brake on international crude prices. However, past expectations on timelines and peak demand levels have missed the mark, as fossil fuels like oil and coal remain the most accessible across China, Asia's largest economy, despite the rapid expansion of renewable energy sources.

Beijing set an annual economic growth target of around 5% this week, a goal that may put pressure on top leaders to unleash more stimulus measures as the government tries to boost confidence in an economy that has been hampered by a prolonged property slump and entrenched deflation.

Even with just 1% growth in crude oil demand, other new energy sources will be able to support an overall economic growth of 5%, said Lu, whose comments echo the findings in the institute's annual outlook report.

China's dependency on imports – more than 70% of its crude oil feedstock and 40% of its natural gas is sourced from overseas – is a concern for policymakers, he said. However, he noted that China is "sensitive but not vulnerable," citing domestic oil and gas production, as well as diversified import channels, as risk-mitigating factors.

The country wants a US-style shale revolution to help it achieve energy security, he said. By 2035, China's shale oil production will rise to 10 million tons per year, he added. In 2023, China produced 4 million tons of shale oil, and achieving the 2035 target may be ambitious, given the amount of water required for shale oil extraction.

In the global crude oil market, current geopolitical risks, including conflicts in Ukraine and the Middle East, have not had a major impact on oil prices, Lu said. He noted that the energy sector has shifted from being a seller's market to a buyer's market, given the energy transition and US shale output. Against this backdrop, producers from Russia to Saudi Arabia will rush to sell more oil, Lu said.

The slowing growth in China's oil demand comes as the country's economic activity has been impacted by various factors, including the prolonged downturn in the property sector and persistent deflation. The government has set a relatively modest annual growth target of around 5% for 2024, which may necessitate further stimulus measures to boost economic confidence and support growth.

China's reliance on imported energy sources, particularly crude oil and natural gas, has been a long-standing concern for policymakers. The country's dependence on overseas sources for more than 70% of its crude oil feedstock and 40% of its natural gas supplies highlights the need for greater energy security and diversification of supply channels.

To address this issue, China is actively pursuing the development of its domestic shale oil and gas resources, with the aim of replicating the success of the shale revolution in the United States. However, achieving the ambitious target of increasing shale oil production to 10 million tons per year by 2035 may prove challenging, given the significant water requirements for hydraulic fracturing operations.

Despite these efforts, fossil fuels like oil and coal remain the most accessible energy sources in China, even as the country rapidly expands its renewable energy sector. This has led to discrepancies between past projections and actual demand levels for oil and other fossil fuels, as their continued use remains widespread across the country's vast economy.

In the global oil market, Lu Ruquan noted that current geopolitical risks, such as the conflicts in Ukraine and the Middle East, have not had a significant impact on oil prices. He attributed this to the ongoing energy transition and the rise of US shale oil production, which have shifted the energy sector from a seller's market to a buyer's market.

In this environment, major oil-producing countries like Russia and Saudi Arabia are expected to compete aggressively to sell more oil, as demand growth slows and alternative energy sources gain traction.

The slowdown in China's oil demand growth reflects the broader challenges facing the country's economy, including structural imbalances and the need for ongoing reforms. While the government has set a growth target, achieving it will require concerted efforts to stimulate economic activity, boost consumer confidence, and address long-standing issues such as the property market downturn and persistent deflation.

At the same time, China's pursuit of greater energy security and its efforts to develop domestic shale resources underscore the country's recognition of the importance of diversifying its energy supply sources and reducing reliance on imports. However, the ambitious targets set for shale oil production may face hurdles, particularly in terms of the significant water requirements for hydraulic fracturing operations.

As the world's largest oil importer, China's energy needs and policies will continue to have a significant influence on global oil markets and pricing dynamics. The country's transition towards a more sustainable energy mix, while addressing domestic energy security concerns, will be closely watched by international energy markets and policymakers alike.