Crypto Young Investors: BaFin Study Reveals over 50% Trust Social Media and Finfluencers

A recent study by BaFin indicates a growing trend among younger investors. Many individuals aged 18 to 45 are turning to social media for financial information. This shift is particularly evident in the land of cryptocurrencies, which are gaining popularity among these groups.Young Investors Trust Social MediaIn May 2024, BaFin conducted a survey involving 1,000 consumers who had invested in the past two years. The findings reveal that social media, especially platforms like YouTube and Instagram, is increasingly seen as a reliable source for financial guidance. Over half of the respondents from generations Y, (Millennials) and Z (Gen Z) consider social media a good alternative to traditional financial advice.This trend is mirrored in their investment behaviours. Users who engage with social media have diversified their portfolios more than those who do not. Specifically, these investors have expanded into a variety of asset classes, with notable increases in securities and crypto assets.Generational Shifts in Investment PreferencesThe survey highlights generational differences in investment preferences. Millennials tend to favour traditional investments, such as call money and fixed-term deposits. In contrast, Gen Z shows a stronger inclination towards cryptocurrencies and precious metals. The popularity of crypto assets has surged; 32 percent of respondents reported investing in them in the past two years. This marks a significant increase from just five percent noted in a prior OECD survey two years ago.Finfluencers Shape Investment DecisionsThe correlation between social media usage and crypto investment is striking. Among social media users, 43 percent have invested in crypto, while only 25 percent of non-users reported similar investments. This suggests that social networks play a critical role in shaping investment decisions, particularly regarding cryptocurrencies.Finfluencers, or social media influencers who provide financial advice, are influential in this context. More than half of those surveyed have sought financial information from finfluencers. Almost 90 percent acknowledge that these individuals offer investment tips, predominantly focused on stocks and crypto assets.Links Influence Purchase DecisionsThe impact of finfluencers extends to actual investment actions. The study found that 80 percent of respondents who follow finfluencers also noticed links to investments provided by them. Of those, 57 percent made purchases directly through these links, while an additional 25 percent invested but did not use the provided links.Despite their influence, finfluencers are not currently required to disclose their financial relationships or compensation related to the tips they provide. The survey revealed that many young investors are unaware of the potential for compensation. About 37 percent did not know that finfluencers typically receive payment for their recommendations. Among those who purchased products via a finfluencer's link, 15 percent were unaware of the compensation practices. This article was written by Tareq Sikder at www.financemagnates.com.

A recent study by BaFin indicates a growing trend among younger investors. Many individuals aged 18 to 45 are turning to social media for financial information. This shift is particularly evident in the land of cryptocurrencies, which are gaining popularity among these groups.

Young Investors Trust Social Media

In May 2024, BaFin conducted a survey involving 1,000 consumers who had invested in the past two years. The findings reveal that social media, especially platforms like YouTube and Instagram, is increasingly seen as a reliable source for financial guidance.

Over half of the respondents from generations Y, (Millennials) and Z (Gen Z) consider social media a good alternative to traditional financial advice.

This trend is mirrored in their investment behaviours. Users who engage with social media have diversified their portfolios more than those who do not. Specifically, these investors have expanded into a variety of asset classes, with notable increases in securities and crypto assets.

Generational Shifts in Investment Preferences

The survey highlights generational differences in investment preferences. Millennials tend to favour traditional investments, such as call money and fixed-term deposits. In contrast, Gen Z shows a stronger inclination towards cryptocurrencies and precious metals.

The popularity of crypto assets has surged; 32 percent of respondents reported investing in them in the past two years. This marks a significant increase from just five percent noted in a prior OECD survey two years ago.

Finfluencers Shape Investment Decisions

The correlation between social media usage and crypto investment is striking. Among social media users, 43 percent have invested in crypto, while only 25 percent of non-users reported similar investments. This suggests that social networks play a critical role in shaping investment decisions, particularly regarding cryptocurrencies.

Finfluencers, or social media influencers who provide financial advice, are influential in this context. More than half of those surveyed have sought financial information from finfluencers. Almost 90 percent acknowledge that these individuals offer investment tips, predominantly focused on stocks and crypto assets.

Links Influence Purchase Decisions

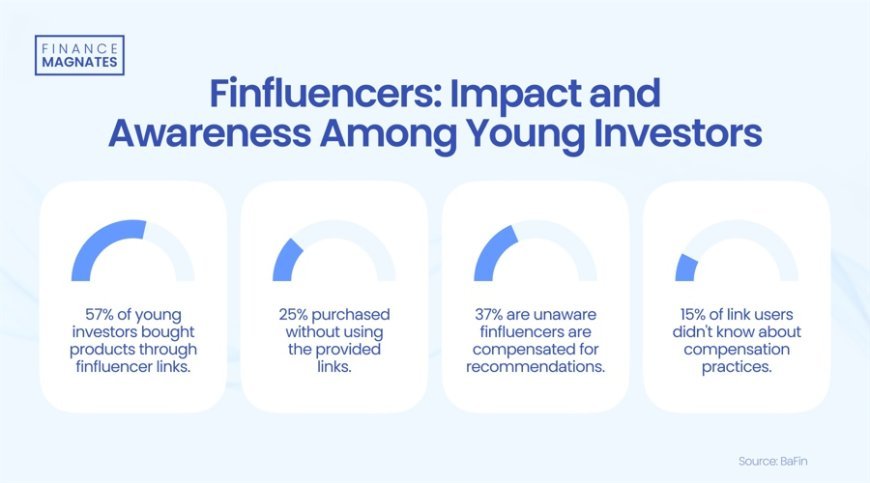

The impact of finfluencers extends to actual investment actions. The study found that 80 percent of respondents who follow finfluencers also noticed links to investments provided by them. Of those, 57 percent made purchases directly through these links, while an additional 25 percent invested but did not use the provided links.

Despite their influence, finfluencers are not currently required to disclose their financial relationships or compensation related to the tips they provide. The survey revealed that many young investors are unaware of the potential for compensation.

About 37 percent did not know that finfluencers typically receive payment for their recommendations. Among those who purchased products via a finfluencer's link, 15 percent were unaware of the compensation practices. This article was written by Tareq Sikder at www.financemagnates.com.